Justice minister orders full-scale review of PI reforms, rejecting Treasury’s optimistic verdict

The Ministry of Justice has stunned Westminster by announcing a full-scale review of personal injury reforms—directly challenging the Treasury’s glowing assessment of the impact of the Civil Liability Act.

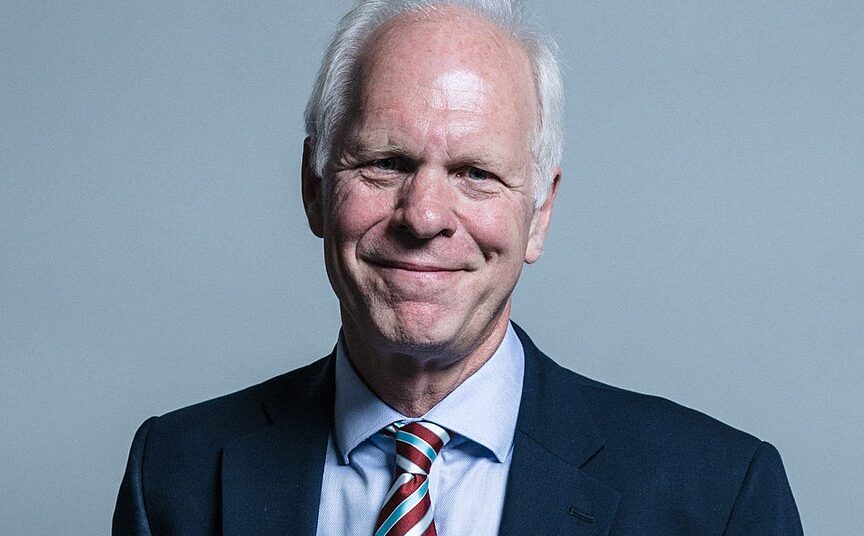

Justice minister Sir Nic Dakin confirmed in parliament that a post-implementation review will begin later this year, saying it was “right and proper” to re-examine the controversial changes that reshaped compensation for soft tissue injuries.

The intervention marks a rare act of defiance against the Treasury, which just last month released a short, 10-page evaluation praising the success of the 2018 Act. That document, required by law, claimed motorists were paying less for insurance than they would have without the legislation—relying solely on insurer-supplied figures presented in three tidy tables.

But Sir Nic pulled no punches in distancing his department from that narrative. “Although it is a factual reporting of the information from insurers provided to HMT through the Financial Conduct Authority, it does not represent the government’s view,” he said during his brief but pointed speech.

The Civil Liability Act ushered in major changes to the personal injury landscape. Most notably, it imposed a fixed tariff on compensation for whiplash and other soft tissue injuries lasting up to two years—amounts generally far lower than previously awarded. It also hiked the small claims limit from £1,000 to £5,000, effectively locking lawyers out of the process for many lower-value road traffic accident claims, as their fees were no longer recoverable.

Additionally, a new pre-action protocol for claims under £5,000 was introduced, placing greater procedural burdens on claimants.

Despite the Treasury’s upbeat report, critics—especially within the legal sector—have long argued that the reforms curtail access to justice and risk under-compensating injured parties. Those fears appear to have resonated inside the MoJ.

Embed from Getty ImagesIn a notable policy shift, Dakin confirmed the government would increase the whiplash compensation tariff by around 15% for incidents occurring on or after 31 May. That rise, set to last until 2027, is intended to provide a “buffer” to safeguard access to justice and prevent unfairly low payouts.

Dakin’s remarks also hinted at judicial frustration over the extent of ministerial interference in what had traditionally been a judicial domain. He revealed that Lord Chancellor Alex Chalk had consulted the Lady Chief Justice before introducing the tariff uplift, and acknowledged that the Master of the Rolls—acting on her behalf—had offered guarded support.

While the judiciary endorsed the tariff increase, they also issued a quiet rebuke: “The judiciary would not welcome any further derogation from the principle that damages are assessed and awarded by the courts,” Dakin relayed.

As if to underscore the government’s growing unease with legal costs and liability trends, the National Audit Office simultaneously announced it would conduct a wide-ranging review into the ballooning cost of clinical negligence claims. Due to report this autumn, the NAO’s inquiry will examine what’s driving surging in-year payments and the escalating value of long-term liabilities.

Those figures are stark: in 2023–24 alone, the cost of clinical negligence claims reached £2.8 billion—a 6.8% rise on the previous year.

With both the MoJ and NAO now digging deeper into the financial and legal fallout of injury litigation, the government’s once-confident narrative of reform success is coming under unprecedented scrutiny.