Charter’s $34.5bn acquisition of Cox’s cable empire signals a US broadband consolidation surge

Two of the biggest names in US law – Wachtell Lipton Rosen & Katz and Latham & Watkins – are steering Charter Communications’ $34.5bn mega-merger with Cox Communications, a move that will reshape the American broadband and mobile market.

Charter, advised by Wachtell, is set to absorb Cox’s commercial fibre, managed IT and cloud businesses. Meanwhile, Cox’s residential cable arm will join Charter’s existing subsidiary partnership, Charter Holdings. On the other side of the table, Latham is advising Cox, with its M&A specialists Brad Faris and Victoria VanStekelenburg leading negotiations from Chicago and Washington DC, supported by communications partner Matthew Brill.

Embed from Getty ImagesThe complex deal structure underscores its scale. Cox Enterprises – the private, family-run parent of Cox Communications – will receive $4bn in cash, $6bn in convertible notes, and 33.6 million common units in Charter Holdings. Those units, valued at nearly $12bn, can be swapped for Charter shares. On top of that, Charter will take on approximately $12bn of Cox’s debt.

The result: a US cable and mobile titan, combining regional strengths and technical capabilities to deliver high-speed internet, video, voice and wireless services across a unified network.

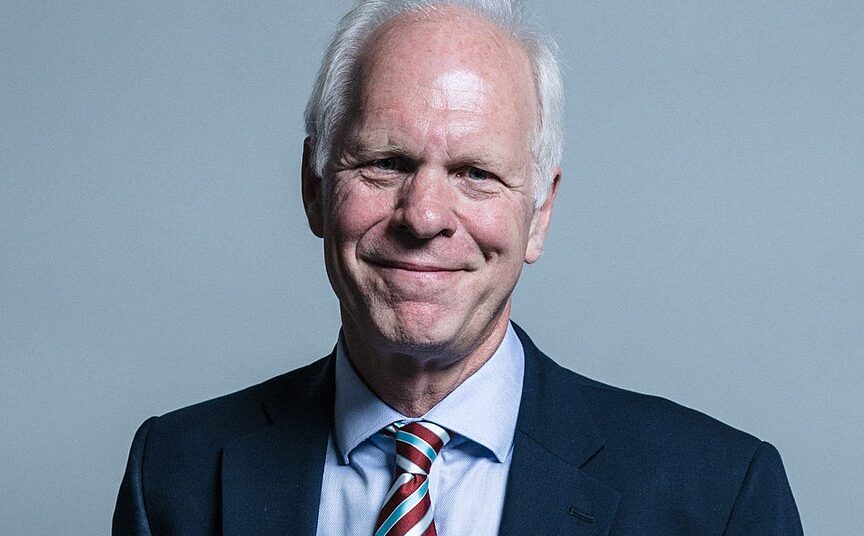

“This is a combination of two American innovators in connectivity,” said Chris Winfrey, president and CEO of Charter. “We’ve spent decades and billions building complementary networks, and this merger allows us to continue delivering value-driven services for American families.”

Winfrey also echoed political undertones, pledging the merger will help reshore jobs to the US – a nod to Republican priorities. “We’ll onshore jobs, create well-paying American careers with benefits, and invest in employee training and ownership opportunities,” he added.

Regulatory approval is still pending, but Charter is optimistic. This latest move follows its November 2024 acquisition of Liberty Media’s broadband business, a deal where Wachtell again represented Charter and O’Melveny & Myers acted for Liberty. Charter aims to close both transactions simultaneously.

The flurry of activity comes amid a resurgent M&A landscape. Global dealmaking reached $885bn in Q1 2025 – up 15% year-on-year – marking the best opening quarter since 2022, according to data from the London Stock Exchange Group.

The strategic motivations behind the Charter–Cox merger reflect a broader industry trend toward consolidation and integrated service models. With streaming demands, mobile bundling, and infrastructure expansion reshaping consumer expectations, legacy cable players are moving fast to defend and grow market share.

Financial advice is also flowing from some of Wall Street’s top firms. Charter is leaning on Citi and LionTree, while Cox Enterprises is working with Allen & Company. For Cox Communications specifically, BDT & MSD Partners, Evercore and Wells Fargo are guiding the numbers.

Though Charter’s purchase involves some complex financial engineering, analysts suggest the benefits could be substantial – especially in rural broadband and enterprise-grade services. Charter will gain enhanced fibre reach and business client capabilities, while Cox’s family owners retain a significant economic interest without giving up full control.

For now, the market awaits regulatory verdicts, but with Charter’s recent momentum and its growing legal and financial arsenal, the merger appears set to push the boundaries of what a modern US telecoms giant looks like